Home to 264 million people, Indonesia is the world’s fourth most populous country.

The major driver of economic growth is its middle class, which has grown by around 12% annually since 2002. This cohort has a healthy appetite for imported, high-quality products, making Indonesia the fastest growing beauty and wellness market in Asia, especially for female consumers.

There’s also a growing trend of urban men spending more on cosmetics and skincare products, with the sale of men’s grooming products increasing by 7.6 percent in 2019.

(Source: Euromonitor International, Beauty and Personal Care in Indonesia, August 2020).

Finding a Suitable Partner for Your Brand in Indonesia

Under Indonesian law, all imported products must be represented by an Indonesian partner, which must register the products with appropriate government bodies before it can be marketed online or in-store. Depending the HS Code of your product, majority of products requires registration with different government bodies.

For all cosmetics and other personal care products, Badan Pengawas Obat dan Makanan ("BPOM") is the equivalent of the Therapeutic Goods Act (“TGA”) in Australia or the Food and Drugs Agency (“FDA”) in the United States. BPOM is the main body that regulates the importation of beauty products, cosmetics, food, supplements and drugs to Indonesia. The process of obtaining product registration with BPOM can take between three months to three years, with rapidly changing rules and legislation.

For textile and toys articles, Sertifikasi Nasional Indonesia (“SNI”) must be obtained before the products can be freely sold in Indonesia.

Distribution Channel in Indonesia

The distribution channels for consumer products in Indonesia rely heavily on modern retail chains, with department stores, drug stores, supermarkets, hypermarkets and specialty stores rapidly investing and transitioning to omni-channels since Covid, fuelled by the strong growth of online content consumption all across age groups. Whilst the number of visitors at offline stores in Indonesia has reduced due to shifting customers' online shopping habits and minimising physical interaction - which is a continuing behaviour post Covid-19, we expect the offline distribution channels segment to have moderate growth in the Indonesia retail market during the 2024-2028 period.

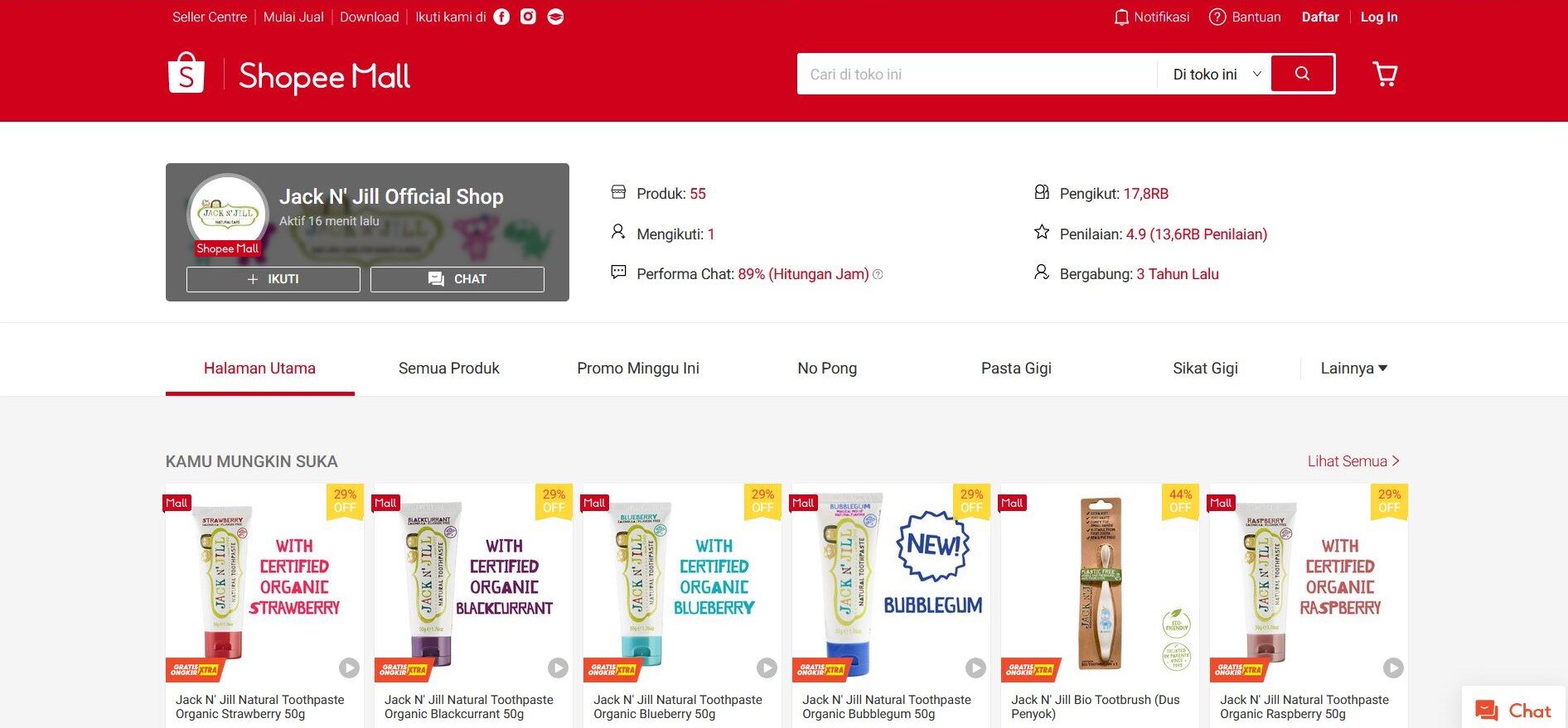

In the online channel, the country busiest eCommerce marketplace by way of monthly visits in 2024 are Shopee (227.6M), Tokopedia (95.6M), Lazada (43.6M), Blibli (23.1M), Bukalapak (4.2M).

While the availability of products from unorganised market players (read: grey imports) poses a serious threat to the organised retail market, eCommerce in Indonesia remains heavily protected from outside entries for three reasons:

A blanket ban on e-commerce platforms from selling certain foreign goods with a value under USD 100.

The regulation was under the revision of Minister Trade Regulation No. 50/2020 (MR 50/2020) on Provisions for Business Licensing. Advertising, Development and Supervision of Business Actors in Trading through Electronic Systems. The products that are traded must adhere to Indonesian standards, such as the Indonesian National Standard (SNI) and the Food and Drug Supervisory Agency (BPOM). Standards like these are the same as the standards for goods circulating in the offline market. It means selling cosmetics, personal care, household goods, clothing and toys articles on any online platform in Indonesia which do not have registration with SNI or BPOM is illegal.

Strong cross-border controls putting a progressive import tariff and taxes on all e-Commerce transactions from outside Indonesia greater than USD 3, the major reason why most of global e-commerce platforms such as Amazon, eBay, AliExpress or Temu can not penetrate the Indonesian market is that Indonesian customers can not transact on this platforms without being subjected to high custom fee and delivery costs upon receipts of their orders.

A heavily regulated e-commerce market by Indonesian government.

One very recent casualty is TikTok (owned by Singaporean-based Byte-Dance). In late 2023, TikTok had been forced to close its relatively new e-commerce service, TikTok Shop, in Indonesia after the country official banned online shopping on social media platforms last year, citing the need to protect smaller merchants and users' data. It has since been forced to merge its TikTok Shop Indonesia with the local e-commerce platform Tokopedia and adopted Tokopedia name.

A brand wishing to enter Indonesian distribution channels must also take into account the difference in margin expectation from both offline and online operators, which in turn will affect your sales strategy to the region. A typical offline presence in the premium import market will require brand to provide a minimum of 35-40% margin to the store. In contrast, an official shop in either Shopee or Tokopedia marketplace will be subjected to a 10-12% marketplace commission. A further 20%-25% marketing support in the form of general rebates, conditional rebates, listing fees, display fees and promotional event support are to be expected to faciliate offline modern retail chain presence.

Grow Your Business with PT. MUM

PT. MUM is a private company based in Jakarta. We are a team of passionate parents who live and breathe natural lifestyles. We believe everyone has the right to a healthier body and live an active lifestyle, on a greener planet.

Founder Daisy Wirijadinata is a Sydney-based Indonesian entrepreneur who divides her time between Australia and Indonesia. Specialising in natural beauty and lifestyle products, PT. MUM has been actively working with brands from Australia, New Zealand, Norway and USA since 2015.

We work with intellectual property consultants and legal advisers to obtain government registrations, product liability insurance, business licences, work permits, import licences and periodic renewals so that you can be confident that your brand and products are always up to date with the Indonesian regulations. As part of new brand onboarding process, we provide comprehensive checklist of documentations required from you to ensure a smooth and efficient registration process.

Our well-established distribution channels mean that we have a footprint in Jakarta and Indonesia’s second-tier cities, covering both offline and online independent baby shops, health food stores, outdoor lifestyle stores and multi-platform retail chains across all the major cities in Indonesia. Our exclusive partnership with Shopee Indonesia, the country’s largest e-commerce operator, means that we have dedicated relationship manager assigned to grow our brands’ official online shop and can assist in minimising price wars and margin erosion among online retailers in the platform.

Our in-house marketing production team consists of in-house graphic designers and a pool of contributors to produce localised content that efficiently engages your target market.